Navigating the binary realm with Binadax: A beginner’s guide to lucrative trading

Binadax: basics of binary options

Binary options are financial instruments that offer fixed returns based on a simple yes or no proposition. Traders speculate on the price movement of various assets, such as currencies, commodities, stocks, or indices. Unlike traditional trading, binary options have predetermined expiration times, ranging from minutes to hours. Traders must decide whether the chosen asset’s price will rise or fall before the option expires.

Binary options have a binary nature, requiring traders to predict price movement without purchasing the actual asset. A correct prediction at expiration results in a fixed payout, while an incorrect one leads to the loss of the investment.

Various types of binary options exist, including Binadax’s high/low options, one-touch options, and boundary options. High/low options predict whether the price will be above or below a certain level at expiration. One-touch options require the price to touch a specific level, and boundary options involve predicting if the price will stay within or go beyond a predetermined range.

Understanding these basics is crucial for beginners entering the world of Binadax binary options trading. The upcoming sections will delve into the advantages and risks associated with this form of trading and provide insights into how newcomers can initiate their trading journey.

Advantages and risks in trading

Advantages

Risks

Getting started with Binadax

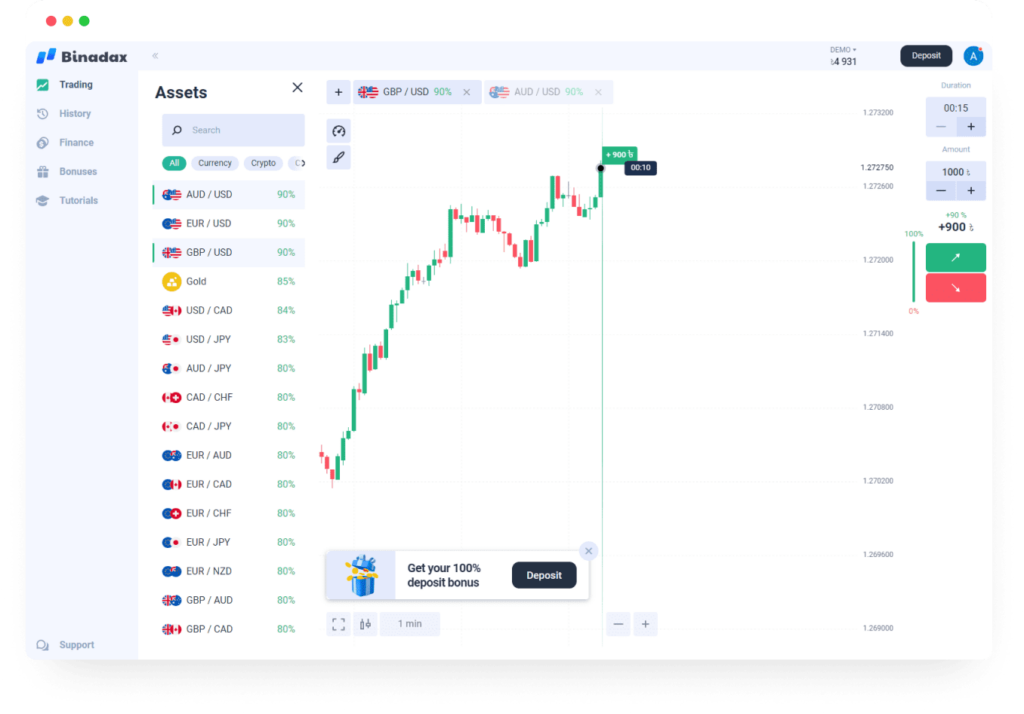

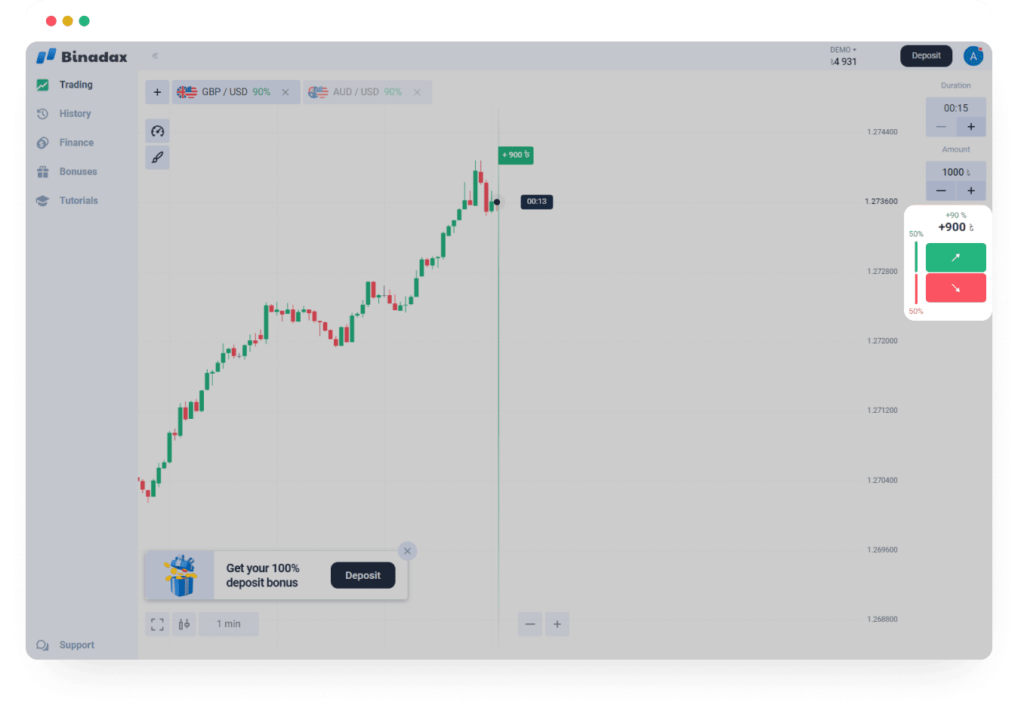

Step 1. Choose an asset

Binadax presents the opportunity to engage in trading across a diverse spectrum of assets, encompassing currency pairs, commodities, a variety of global company stocks, and indices from countries worldwide.

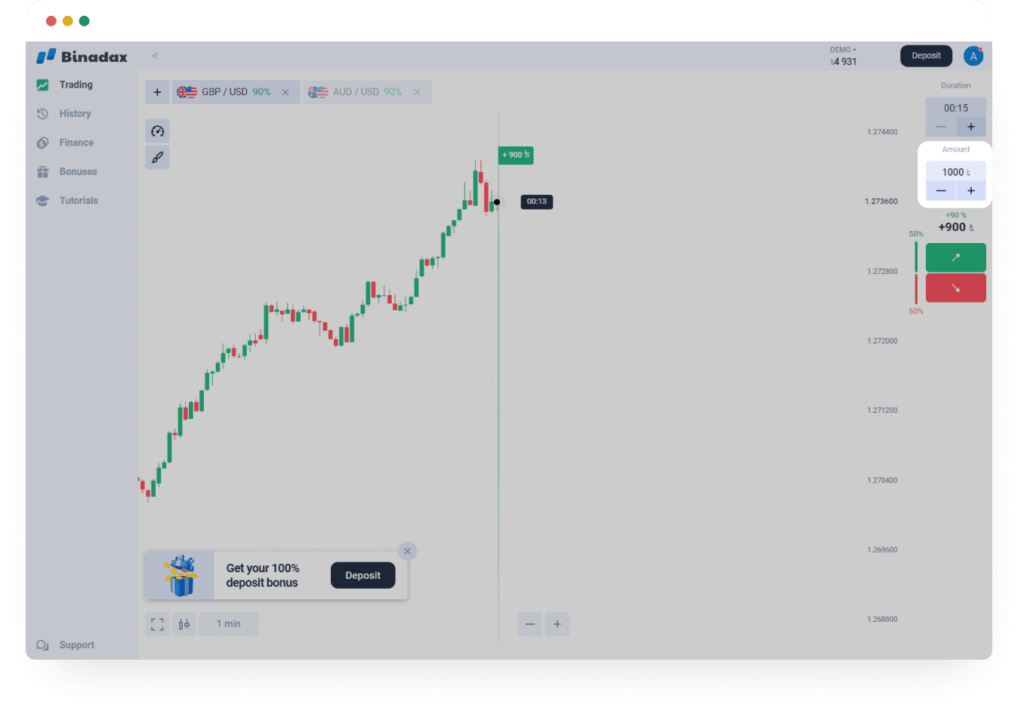

Step 2. Determine the transaction amount

Remember that the potential profit is directly tied to the chosen transaction amount.

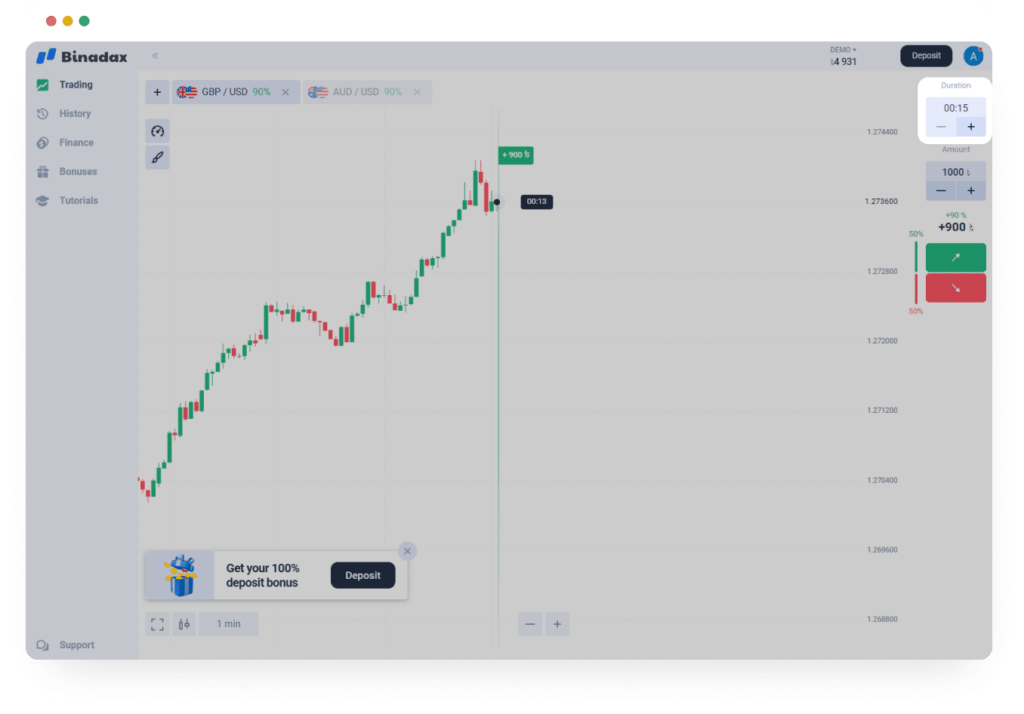

Step 3. Time frame selection

Choose the timeframe within which you anticipate your prediction to unfold and be validated.

Step 4. Directional decision

Your final step involves determining the direction of the graph, utilizing the up and down buttons based on a variety of factors and your knowledge.

Comprehending these four uncomplicated steps elucidates why trading is experiencing a surge in popularity each day. Few other investment tools provide comparable income potential within such a brief period. Another notable benefit of trading is the absence of the necessity to download additional software or possess a background in economics or finance.

To generate income, a basic grasp of the economic market and access to the latest news in the financial and economic spheres are ample, a principle emphasized by Binadax.

Binadax’s guide to risk management strategies in trading

Effective risk management is vital for sustained success in binary options trading. Here are key strategies to minimize potential losses and optimize your trading approach.

Diversification

Spread your investments across different assets and market sectors, utilizing the diverse options available on the Binadax platform. This helps mitigate the impact of a poor-performing asset on your overall portfolio.

Asset allocation

Determine the percentage of your total capital to allocate to each trade. Avoid putting all your capital into a single trade, as this can lead to substantial losses.

Set realistic goals

Establish achievable profit targets and acceptable loss limits for each trade. Having realistic expectations helps you avoid excessive risks and emotional decision-making.

Use stop-loss and take-profit orders

Implement stop-loss orders to automatically exit a trade when a certain loss threshold is reached. Similarly, set take-profit orders to secure profits when a predetermined target is achieved.

Risk-to-reward ratio

Assess the potential reward against the risk before entering a trade. Aim for a positive risk-to-reward ratio to ensure that potential profits outweigh potential losses.

Stay informed

Keep yourself updated on market news and events that may impact your selected assets. Informed decision-making is crucial for mitigating unexpected risks.

Avoid overtrading

Resist the urge to overtrade. Adhere to your strategy and execute trades only when they align with your predetermined criteria.

Use demo accounts

Hone your trading strategies using demo accounts provided by brokers, such as Binadax. This enables you to refine your approach without risking actual capital.

Continuous learning

Commit to ongoing education in financial markets and trading strategies. A well-informed trader is better prepared to make prudent decisions.

Monitor and evaluate

Regularly assess your trading performance on the Binadax platform. Analyze both successful and unsuccessful trades to identify patterns and adjust your strategy accordingly.

Remember, effective risk management is a continuous process that demands adaptability. By integrating these strategies into your trading routine, you enhance your ability to navigate the unpredictable nature of financial markets while optimizing your potential for long-term success.